This a look back at a mishap that happened to me a year and a half ago. I hope you enjoy the read as much as I despised that moment (at the time) :-)

Never miss a new post

Liquidity Mining

First, some context. Liquidity mining on Hummingbot is a program that allows you to reap in rewards based on how close your market orders (buy / sell) are to the mid price. These rewards are calculated on a minute-by-minute basis.

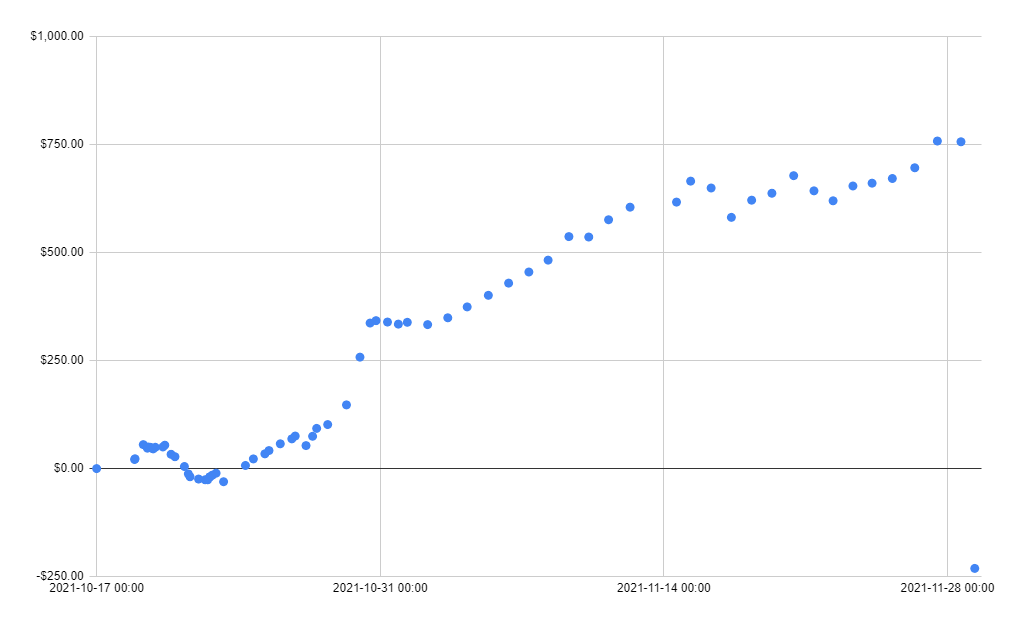

Starting on October 17th 2021, I invested exactly $1323 and started trading on multiple trading pairs on AscendEx. Religiously tracking my daily returns, I was enjoying the steady gains. Some great days, some average days, but by the end I had a healthy 57% profit ($756). A consistent ~0.5% daily return.

What I gradually realized was that the highest ROI trading pairs were the one with very low trading activity: you could set a market order ridiculously close to the mid price (less than 0.05% away) and just reap in the rewards. Almost no one was trading on the pair, so your market orders almost never got triggered. When they did, your trade loss (due to the trading fees being higher than your spread) would be offset by the rewards you had accumulated.

Here's how my returns looked like on November 28:

My liquidity trading profits as of November 29th 2021. Starting funds: $1323. You might notice a slight drop by the end...

The Burn: FXS/USDT trading pair

I had started trading on the FXS/USDT pair a few days prior. It was doing OK, very few trades, tight spreads.

On November 28th, it so happens that I was looking at the order book at the end of the afternoon. I noticed something interesting: there were no ask orders. None. No one had any open orders to sell FXS. Being my naive self I thought: wow that's interesting.

My bot was looking at a specific number to place orders: the mid price. I.e. half-way between the top bid and top ask. If the best ask is $20.01, and the best bid is $19.99, the mid price is $20.00. Easy enough.

What happened next is that someone posted a market ask order at $1000. I saw it live. Essentially saying "You know this token called FXS that just traded at $20.50? Well I'm happy to sacrifice myself and buy your tokens for the low price of $1000.". You might see where this is going...

What's the mid price when the best bid is $20 and the best ask $1000? $490. My bot being the clever thing it is, decided to do what it does best and post a great bid order at 0.01% of the mid price: $489.51. Saying in return "You think $1000 is a great price? Well then I don't mind buying FXS at $489.51 then."

The daily FXS/USDT candles around November 2021. See that ridiculous high candle on Nov 28th? This is a log-scale by the way. But who could've bought FXS at such an awful price?

Then what had to happen happened: someone saw that, sold their tokens to my unsuspecting bot. And then my unsuspecting bot decided to open more buy orders because it still had USDT to spare!

It took me about 20 seconds to realize what was happening and franctically stop my bot ASAP. By then, the damage was done and I was holding 2 FXS token worth around $40. I had payed close to $1000 for those.

The Fallout

After that incident, I took a pause from liquidity mining. Came back some time later, but stopped participating in the Hummingbot Miner program and instead focused on other strategies.